operating cash flow ratio importance

Understanding a businesss ability to pay off its current liabilities Evaluating the liquidity of a business Gaining insight into the financial state of a business Making smart investments. Operating cash flow is a measurement of a businesss cash flow and uses and is the best indicator of business profitability.

Cash Flow Formula How To Calculate Cash Flow With Examples

For any business the operating cash flow ratio is an important measure of profitability.

. Some of the main advantages of analyzing operating cash flow ratio include. Operating cash flow OCF ratio is a metric to help understand how liabilities are impacting a business and whether its in the best position to grow. The operating cash flow ratio provides a clear financial assessment of your companys needs and.

Operating cash flow is intensely scrutinized. Cash flow ratios are sometimes reserved for advanced financial analysis. Cash is what keeps businesses running and a high operating cash flow is an.

Its ability to pay off short-term financial obligations. In the case of a small business cash is very important for survival. A key advantage of the operating cash flow ratio is that cash flows are generally considered to be a better indicator of financial condition than a firms reported profits.

Operating cash flow is particularly important for investors who often look at both OCF and net income when deciding to invest or not. Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth. Operating cash flow is an important metric because it shows investors whether or not a company has enough funds coming in to pay its bills or operating expenses.

Operating Cash Flow Net Income - Changes in Assets and Liabilities Non-Cash Expenses 100000 50000 20000 25000 10000. In the end OCF reveals how much cash is generated from the core operations of your business. Importance of operating cash flow.

This may signal a need for more capital. A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate. The numerator of the OCF ratio consists of net cash.

It would serve a business owner or manager well to calculate the cash flow ratios in order to have an accurate picture of the actual cash position and viability of the business. It is important to understand cash flow from operations also called operating cash flow the numerator of the operating cash flow ratio. Uses of Operating Cash Flow Ratio It measures the ability of a firm to pay off its immediate debts It gauges the earnings that a company has generated through its functions It helps investors and business analysts to compare competitive businesses with.

What does operating cash flow ratio signify. Calculating and monitoring operating. Operating cash flow OCF ratio.

Operating cash flow ratio is used to understand if a company can pay off its liabilities or payables ie. This ratio calculates how much cash a business makes as a result of sales. So we can see that Radha succeeded in generating 55000 of cash flows from her operations.

Understanding and identifying operating cash flow ratio is a crucial part of financial monitoring to ensure businesses are performing well. OCF is just one part of cash flow and it is typically a big part of what makes your company profitable. For starters the operating cash flow ratio shows the overall health of your businesshow much money it has managed to accumulate from its basic activities.

Operating cash flow is an important benchmark to determine the financial success of a companys core business activities. When a business uses the accrual basis of accounting it may include non-cash entries in the derivation of profits so the firm is reporting profits even when its cash flows may be negative. This is very important to the overall health of your business and the larger picture of cash flow.

The operating cash flow ratio is a measure of a companys liquidity. Operating Cash Flow 55000. An auditor relying solely on the quick and current ratios in this instance would have missed that important point.

Note that operating cash flow is different from operating cash flow ratio. For small business owners it is essential. It reflects the amount of cash that a business produces solely from its core business operations.

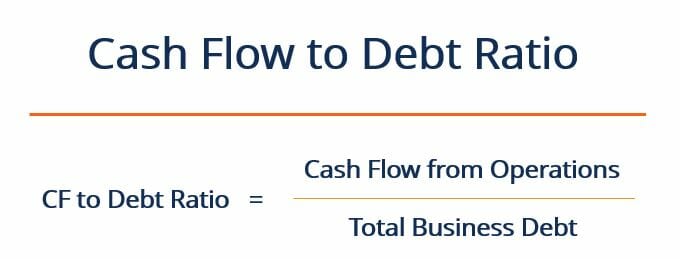

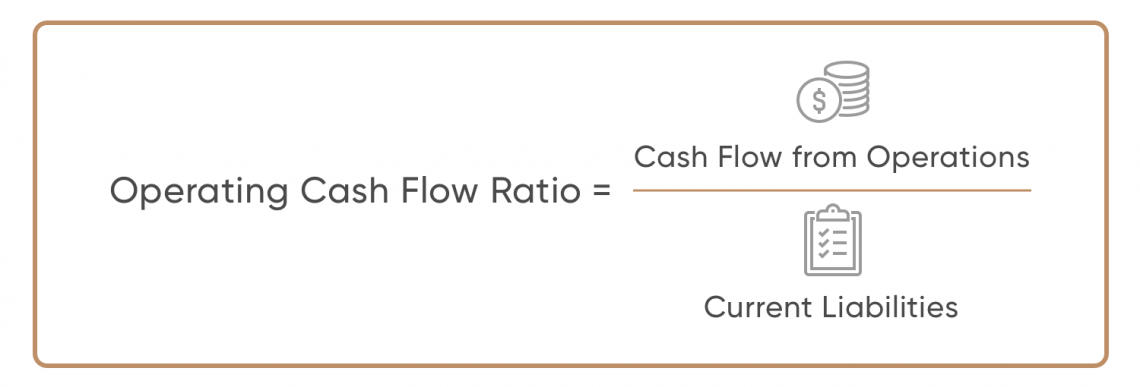

Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow. The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a companys operations. Any money owed by the business at any time with cash generated from business activities.

The operating cash flow ratio tells the number of times a firm can manage paying off its current liabilities using cash within the same time. Operating cash flow OCF is one of the most important numbers in a companys accounts. A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate.

An auditor who bothered to calculate two other cash flow ratiosFFC and cashcurrent debtwould have gotten even more remarkable results. Cash flow ratios are sometimes reserved for advanced financial analysis. This ratio can help gauge a companys liquidity.

Operating cash flow ratio. It demonstrates the changes in working capital such as receivables and inventory and removes the many of the opportunities for manipulation. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities.

Operating cash flow ratio is an important measure of a companys liquidity ie. Thus investors and analysts typically prefer higher operating cash flow ratios. If the value stands to be more than one it signifies that the company has enough cash or more cash than the amount required to be paid off as current liabilities.

Heres how to calculate it. The importance of calculating the operating cash flow formulaand ratiois in being able to see if your business can pay off short-term liabilities. While net income shows if the company is keeping its head above water for now its operating cash flow shows if its actually making moneyand few investors want to put their money down on a business that doesnt generate.

A higher ratio is better. But with so much of your time spent running and growing your business it can be challenging to keep track of just how well your company is doing. It should be considered together with other liquidity ratios such as current ratio.

Operating Cash Flow Ratio Definition Formula Example

Price To Cash Flow Ratio P Cf Formula And Calculation

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Cash Flow From Operating Activities Direct And Indirect Method Efm

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Formula Example Calculate P Cf Ratio

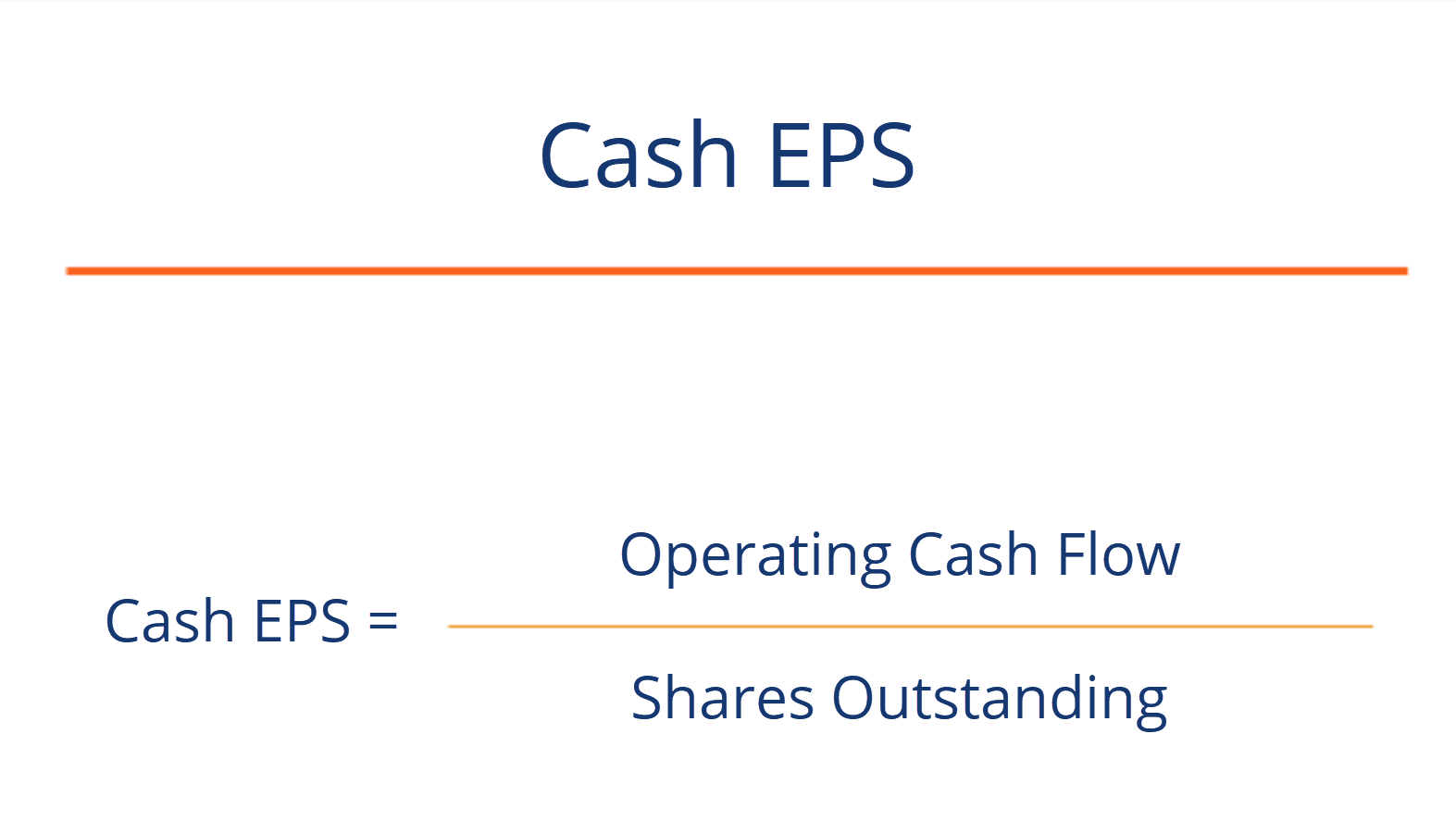

Cash Flow Per Share Formula Example How To Calculate

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Fcf Formula Formula For Free Cash Flow Examples And Guide

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Cash Flow To Debt Ratio Meaning Importance Calculation

Free Cash Flow Operating Cash Ratio Free Cash Cash Flow Cash

Operating Cash Flow Ratio Definition And Meaning Capital Com

Free Cash Flow Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)